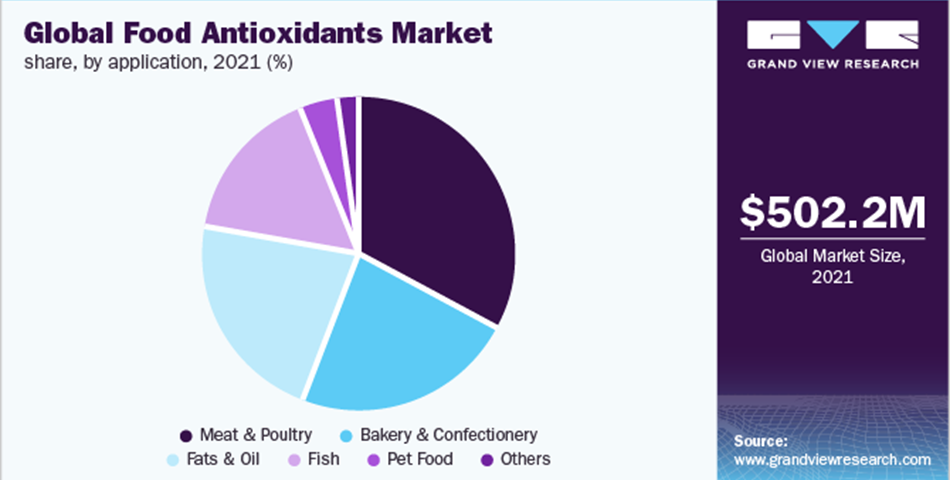

The global food antioxidants market size was valued at USD 502.2 million in 2021 and is expected to witness a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030. The growing application of food antioxidants in a wide variety of prepared meals and packaged food has been the key driver for the growth of the market. The rising requirement for the long shelf life of packaged food is expected to be the major contributor to the escalating demand for food antioxidants during the forecast period.

Rising food consumption on account of growing population has propelled the demand for a wide variety of prepared food globally. Such food comprises meat, poultry, bakery, sweets, confectionery, oil, fish, and many more. These food products are already prepared and kept at the store for a few days prior to selling to customers. Thus, a little portion of food antioxidants is mixed in the formulation of food to provide it with a long shelf life without losing its healthy properties. The rapid increase in the consumption of packaged food across the globe is anticipated to be the key factor for the rising demand for food antioxidants over the foreseeable future.

The shift in consumers’ lifestyles is leading to a change in their preferences for food products. Consumers are highly aware of the variety of food products available in the market and the ingredients used in them as preservatives and nutrients. This factor is likely to contribute to the growth of the food antioxidants market globally over the projected years.

The government of different countries has imposed strict regulations pertaining to the consumption of food antioxidants as an additive in food products. The regulatory bodies have set some strict limitations on the use of antioxidants in food products. Especially, there are several stringent policies introduced by the government in the addition of synthetic antioxidants due to the involvement of chemicals in its formulation. They have defined a certain content level for antioxidants and other related additives and have also made it mandatory for

manufacturers to clearly mention all ingredients that go into the production of prepared food products.

The outbreak of COVID-19 directly affected the meat & poultry market due to massive supply shortages of such food products on account of the shutdown of many food facilities. In addition, consumers tended to avoid meat and livestock food products during the pandemic due to the risk of viruses being transmitted through the meat. However, the rising panic situation on the account of the shutdown of a maximum number of local food stores elevated the consumption of packaged food that could be stored for a longer period. Increasing dependencies on prepared food propelled the consumption of antioxidants in food products during the pandemic.

Market Segmentation

This article forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030, and has segmented the global food antioxidants market on the basis of type, form, application, and region:

Type Insights

The synthetic-type segment dominated the market at a revenue share of over 55% in 2021. The growth is attributable to the rising consumption of butylated hydroxy anisole (BHA), butylated hydroxytoluene (BHT), Tert-butylhydroquinone (TBHQ), and Propyl Gallate (PG) in the production of a wide range of food products. Synthetic antioxidant is a mixture of numerous chemicals and involves a typical industrial process for their formulation. Thus, the government of many countries has imposed some strict regulations on its consumption as an additive. Synthetic antioxidants are widely utilized to increase the shelf life and provide a better texture, color, and fragrance to food products.

Natural antioxidants belong to natural sources such as plants, animals, fruits, herbs, and spices and do not involve a typical chemical operation. Natural antioxidants comprise carotenoids, rosemary extracts, vitamin C, vitamin E, ascorbic acid, alpha-tocopherol, and others. Rising inclination towards maintaining a healthy lifestyle has bolstered the consumption of naturally extracted antioxidants. Growing awareness of health and the side effects of

chemicals is expected to fuel the demand for natural antioxidants over the projected years.

Form Insights

The dry form segment dominated the market with a revenue share of over 72% in 2021. The high share is attributable to the increasing consumption of powder-based antioxidants in food products. Technical grade powders are highly consumable for numerous food products. The powder reduces the effects of free radicals and can significantly decrease the damage caused by them. The majority of food antioxidants are in dry form including powder, tablets, flakes, and granular. Dry antioxidants are widely preferred by consumers owing to the ease of their transport, storage, and usage. Growing prepared food market is expected to drive the demand for dry antioxidants globally over the forthcoming years.

Liquid antioxidants are also used in a wide range of food products, such as fats and oil, mayonnaise, and more. However, liquid antioxidants are complicated to transport, store, and usage. In addition, liquid antioxidants are not easily mixed with all types of food products, and thus, the market is expected to witness a limited demand for liquid antioxidants over the future years.

Application Insights

Meat & Poultry application dominated the market with a revenue share of over 32% in 2021. The growth is driven by the rising consumption of meat and its related food products across the globe. Meat & poultry products are sold in the packaged form which is stored for a long time and consumed according to the need. Food antioxidants preserve the meat from bacteria and fungi and provide a longer shelf life to the meat & poultry products. Growing meat & poultry consumption on the account of its health benefits is anticipated to drive demand for food antioxidants in the coming years.

Bakery & Confectionery market is witnessing rapid innovation on the account of evolving habits and preferences of customers. In addition, the trend of gifting chocolates, sweets, and other confectionery products, especially at festivals is also a contributing factor to the growth of bakery & confectionery market. Increasing consumption of bakery and confectionery products is expected to stimulate the demand for food antioxidants over the forecast period.

Fats & Oil are majorly consumable food products and are expected to record stable growth over the projected years. Fats & oil are sourced from plants such as palm, soybean, olive oil, sunflower, and rapeseed. Fatty acids and vegetable oil is consumed in a wide application of food products, and thus required to be preserved. Food antioxidants provide longer shelf life to fats & oil products and keep it safe from degrading. Growing utilization of fats and oil in food products is likely to escalate the demand for food antioxidants over the future years.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 34% in 2021. The high share is attributable to the rising population in the countries like China, India, and Japan. According to the Food and Agriculture Organization (FAO), China was the largest food producer with an output value of USD 1.56 trillion. The major factor driving the food market in China is the growing population of the country. India is the second most populous country in Asia, which also contributes to the increasing consumption of food. Asia Pacific is one of the majorly impacted regions by the strike of COVID-19. The health crisis has spread awareness for consuming healthy food products across the region. Rising population coupled with the growing consumption of food is expected to augment the demand for food antioxidants over the projected years.

North America captures the second largest revenue share with a share of over 30% in 2021.The high share is attributable to the lifestyles of consumers in countries like the U.S. and Canada. Majority of people are working professionals in North America and thus, rely heavily on prepared food. In addition, the dire COVID-19 situation in the U.S. had compelled its population to have a healthy diet to immunize their body to fight against the virus. Food antioxidants preserve the food for a long time and prevent the formation of free radicals in human body. This factor is likely to fuel the demand for food antioxidants in North America over the next few years.

Europe holds a lucrative opportunity for the growth of food antioxidants market owing to the rising awareness of the health benefits of antioxidants. Rapid economic development and rising disposable income in Europe have propelled the consumption of prepared food across the region. Rising reliance on prepared food is anticipated to elevate the demand for food antioxidants across Europe in the near future.

|

Market Players (Sector Leaders) |

BASF SE, Archer Daniels Midland Company (ADM), DuPont, Kalsec Inc., Kemin Industries, Camlin Fine Sciences, 3A Antioixidants, Eastman Chemical Company, Frutarom Ltd, Barentz Group, Vitablend Nederland BV, Crystal Quinone Pvt Ltd, Sasol Limited, Naturex |

Recent Development

-

In August 2022, Kalsec® partnered with Infinome™ Biosciences to provide naturally sourced and innovative ingredientswith superior quality.

-

In August 2022, Kemin launched ENTEROSURE™, a resilient intestinal health solution. The solution helps to enhance the control of enteric bacterial pathogens to reduce the use of antibiotics.

-

In December 2021, Barentz acquired Gangwal in India to become a major international distributor of specialty drugs and nutraceutical ingredients.

-

In April 2021, Eastman acquired 3F Feed & Food to strengthen its product portfolio and provide customized solutions to challenges faced by its customers.

Acknowledgement

Article provided by Grand View Research

-

Email: sales@grandviewresearch.com

-

Website: https://www.grandviewresearch.com/