Processed Potato Products Market

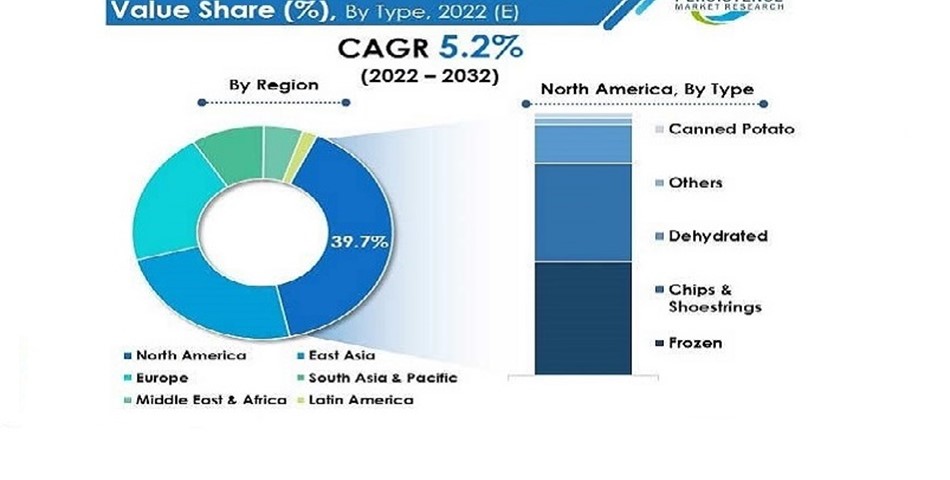

Over the forecast period of 2022 to 2032, the global processed potato products market is anticipated to expand at CAGR of 5.2%. Worldwide consumption of processed potato products is currently valued at US$ 79 Bn, with the market set to reach a valuation of US$ 131.8 Bn by 2032.

|

Processed Potato Products Market Size (2022E) |

US$ 79 Bn |

|

Projected Sales of Processed Potato Products (2032F) |

US$ 131.8 Bn |

|

Value CAGR (2022-2032) |

5.2% |

|

Value Share of Top 5 Countries (2022A) |

~68.5% |

Historically, from 2017-2021, the global market for processed potato products registered a compounded annual growth rate (CAGR) of 3.5%. Sales of processed potato products have increased mainly due to increasing demand for frozen French fries from fast-food chains.

Processed potato snacks are highly demanded in the food & beverage sector due to increasing demand for processed foods, improved farming practices, low-cost availability, and changes in consumer preferences for convenience foods to save efforts and time, all of which have been pushing the global potato processing industry.

Easy availability, convenient packaging, rising urbanization, improvements in level of living, changing lifestyles of the middle-class population, and increasing disposable income are other factors driving market expansion.

The global market for processed potato products is expected to experience significant growth and register a CAGR of 5.2% over the forecast period through 2032.

What’s Driving Consumption of Processed Potato Products?

“Increasing Adoption of Vegan & Organic Food Products to Bolster Sales of Processed Potato Products”

The global processed potato products market is expanding with excellent prospects owing to increasing popularity of vegan food products in well-developed regions as a result of rising health consciousness and concerns for animal welfare.

Moreover, health-conscious consumers increasingly prefer healthier snacks such as olive-baked potato chips, sweet potato fries, organic potato chips, and others to suit their nutritional needs. Baked potato chips have around ~14% fewer calories and ~50% less fat than regular potato chips, making them a healthier alternative that appeals to health-conscious consumers.

Furthermore, ready-to-cook potato products such as fries and snacks are being sold with labels such as vegan or organic to increase sales. In recent years, there has been an increase in demand for organic, plant-based flavors, and clean-labelled potato products

“Rising Demand for Frozen Potato Products to Provide Growth Opportunities to Manufacturers”

Frozen potatoes have a long shelf life and include several vitamins and nutrients in their natural preserved state. Vitamin B6, fiber, magnesium, and antioxidants are also present. Frozen potatoes are created by processing fresh potatoes at a very low temperature using specialized equipment.

Moreover, increasing female work force population as well as resulting time limitations and socializing at home are driving sales of frozen potato products. Increasing nuclear families and young professionals living alone have opened up new options for market players to increase their reach.

Acceptance of the Western culture and increase in demand for freshly cooked food are seen to be factors for the demand growth of convenience food, which indirectly fosters the growth of the frozen potato products industry.

“Expansion of Quick Service Restaurants to Aid Market Growth”

The global market is highly driven by potential dynamics, which include fast-food and quick service restaurants that have now become a necessity. These restaurants serve mass-produced dishes, which are drawing a rising number of customers.

These restaurants are gaining popularity as a result of the convenience they provide and the high quality of their foods. They are also cost-effective in terms of both, money and time. Fast-food and quick service restaurants are growing in popularity because they meet the changing needs of consumers.

Demand for frozen potatoes has increased owing to the growth and expansion of these quick-service restaurants, or QSRs. Frozen French fries, shaped and stuffed or topped with potatoes and hash browns, are high in demand at QSRs since they require less preparation time and are easy to use.

What is Limiting Processed Potato Products Market Expansion?

“Health Concerns about Processed Food & High Cost of Operations”

Primary factors limiting the growth of the potato processing products market are the health concerns concerned with the utilization of processed food items, high acrylamide levels in snack foods, and high cost of storage and transportation.

Processed potato product suppliers face challenges in maintaining continuous or year-round supply of their products at a fair price.

Country-wise Insights

What Countries are Seeing High Demand for Processed Potato Products?

European countries are expected to see growth at a CAGR of 3.2% during the forecast period (2022-2032). These countries have high demand for convenience foods that are meant to save time and efforts.

Countries in the region are also witnessing high demand for ready-to-cook products and snacks, which drives sales of processed potato products across the continent.

How is the East Asia Processed Potato Products Market Evolving?

In East Asia, the China processed potato products market is expected to experience promising growth and register a high CAGR of 8.7%.

Market share of China in the East Asian processed potato products market is around 89.1%, is currently valued at US$ 17.1 Bn.

Category-wise Insights

Which Category of Processed Potato Products Holds the Largest Value Share?

Based on type, frozen potato products account for the largest market share

Market value share of potato chips and shoestrings is 37.2% in 2022, which is projected to be valued at US$ 29.4 Bn by the end of forecast period.

Which Distribution Channel is Expected to Drive High Profits for Processed Potato Product Manufacturers?

Based on distribution channel, sales of processed potato products are segmented into retail and food service, of which, the food service segment holds a major value share in the global market at 51.4% in 2022.

Current market value of the segment is estimated at US$ 40.6 Bn.