Market demand

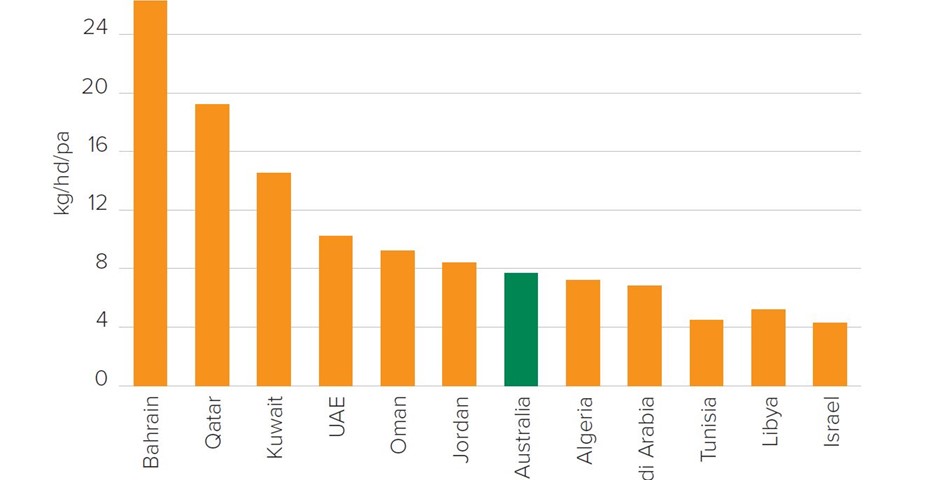

The retail sector remains fragmented, even in GCC countries, but retail development growth is expected to increase, accompanied by growth in chilled red meat sales. Markets with developing tourism sectors are experiencing growth in demand for premium lamb cuts in the high-end foodservice sector. Technical barriers to trade are significant and differ between countries. Although economic growth prospects in the MENA region are strongly impacted by external factors, such as oil prices and conflict, increasing urbanization, growing disposable incomes, westernization, a young population and large expatriate population are key growth drivers for imported red meat demand. Sheep meat is an important part of MENA diets, though per capita consumption in some countries is higher than others. Demand for sheep meat imports also varies, with greatest demand from Saudi Arabia and UAE, followed by Jordan and Qatar. Australian lamb has a high profile and is well-regarded in these markets. Sheep meat is the most loved protein in the hearts and minds of Gulf States consumers, although actual consumption is dominated in volume and frequency by chicken due to its price advantage. Along with a traditional regional preference for lean meat, some consumers are developing a stronger health awareness, which may impact on their meat and lamb consumption. Utilization of Australian sheep meat varies somewhat by country. In UAE, the Australian product goes into both retail and foodservice, whilst in Oman and Saudi Arabia, a significant proportion (especially frozen mutton) goes into foodservice, particularly low end catering. In Qatar and Bahrain, carcases go into butchers, where they are cut up for sale to consumers.

Food service

In some markets that are developing their tourism sectors, such as Dubai, Saudi Arabia and Qatar, demand in the high-end foodservice sector is expected to continue to grow for chilled lamb cuts such as boneless loin, rack and shank. The bulk of Australian frozen mutton imports, which are chiefly carcase and leg, is used in the lower-tier catering sector. In Bahrain, lamb carcases go from butchers into the foodservice sector. However, since the lifting of government subsidies from late 2015, mutton has replaced lamb.