Report Overview

The global food service disposable market size was valued at USD 53.9 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2021 to 2028. The global market is anticipated to be driven by the growing penetration of online food delivery services. Moreover, the increasing popularity of Quick-Service Restaurants (QSRs), especially in the developing regions, such as Asia Pacific, owing to busy lifestyles and hectic work schedules is expected to favor the market growth over the forecast period. The high demand for online food delivery services amid the COVID-19 pandemic is also expected to boost the market growth. The surge in demand is aided by the lockdowns imposed across major cities that restrict hotels, restaurants, and cafes from providing dine-in services.

The U.S. emerged as the largest country for food service disposables in 2020 due to the extensive penetration of QSRs, which are the main consumers of food service disposables. Although the market witnessed a decline in growth in 2020 owing to the pandemic, imposed restrictions to curb the disease spread resulted in exponential growth of online food delivery services, which benefitted the food service disposables market. Disposable food packaging products, such as plates, cups, bowls, and containers, are highly economical as compared to their alternatives, such as non-disposable containers.

Moreover, these products provide convenience to customers and delivery personnel in the overall delivery process. The growth of online food delivery services is aided by platforms, such as Uber Eats, Glovo, Grubhub, Delivery Club, Postmates, Just Eat, and Deliveroo. According to a survey by Uber Eats, in 2019, the share of restaurants on its platform that reported an overall increase in sales after joining was 69% in London, 74% in Paris, and 67% in Warsaw. Thus, growing online food delivery service is expected to lead to a rise in product usage, thereby supporting the market growth.

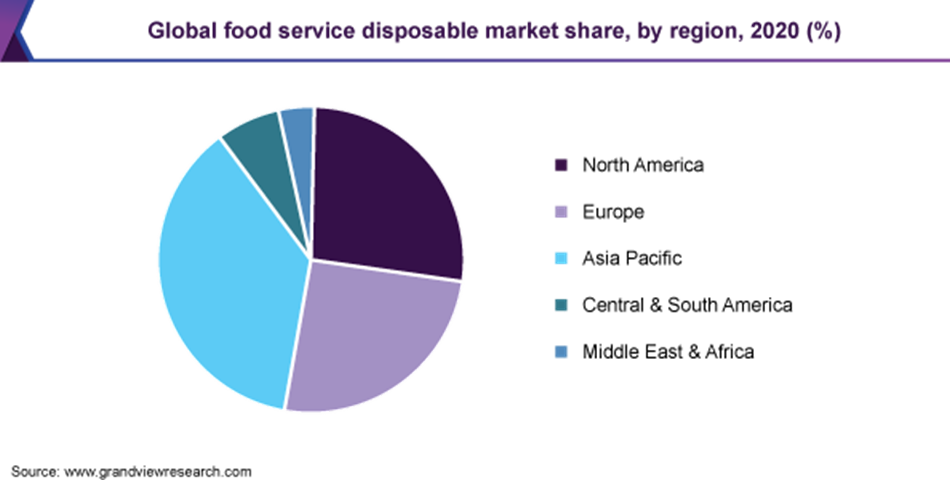

Regional Insights

Asia Pacific dominated the market in 2020 accounting for the largest revenue share of more than 36%. The regional market is anticipated to expand further at the fastest CAGR from 2021 to 2028 owing to the presence of the fastest-growing economies and flourishing food service industry. China is the largest contributor and is anticipated to retain its leading position in the regional market over the forecast period owing to the high density of fast-food restaurants and increasing adaptation to online food delivery systems.

India is also expected to register a significant growth rate in the regional market due to changing economy coupled with the high penetration of the food service industry. The other large markets in the region include Japan, South Korea, and Indonesia. These countries are heavily dependent on online delivery services and this trend is likely to stay in the market for the long term, thereby, benefiting the regional market. North America emerged as the second-largest regional market in 2020. Extensive penetration of hotels & restaurants in the U.S. and Canada and strong per capita spending on hoteling.

Europe is anticipated to witness a sluggish CAGR from 2021 to 2028. The stringent regulations, pertaining to the use of single-use plastic and plastic tableware, is expected to add to the sluggish growth of the market over a forecast period. Starting July 2021, it will be illegal to offer disposable plastic cutlery in the Europe regional market. Such stringent regulations are likely to hinder market growth in the years to come. Although, amid such developments, the demand for paper-based alternatives is anticipated to witness significant growth in Europe.